Toward Achieving Carbon Neutrality

Climate-Related Disclosures Based on the TCFD

Basic Concept

Addressing climate change (decarbonization and carbon neutrality) is a pressing issue that must be addressed globally, and the construction industry has an important role to play in this regard.

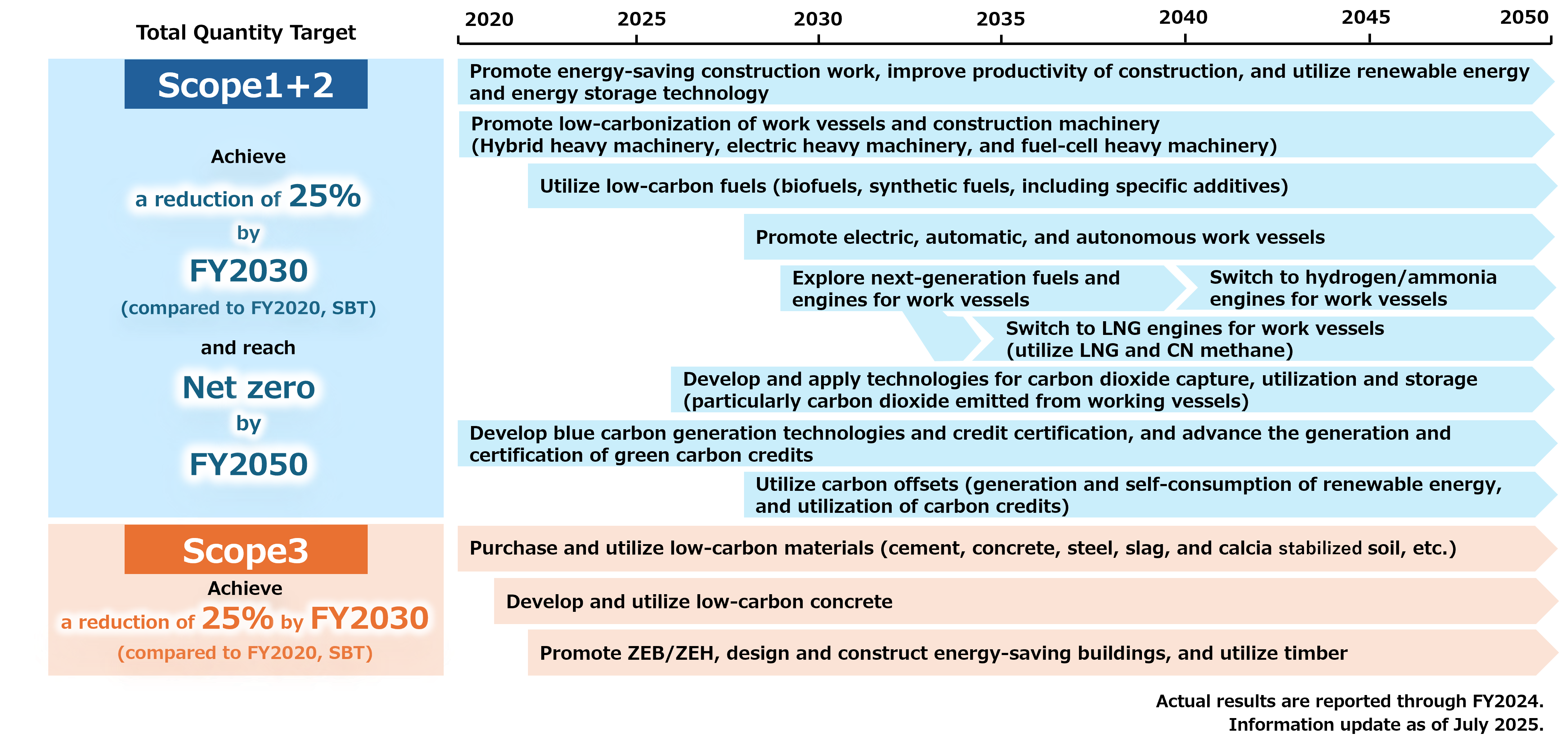

In FY2021, we set mid-term targets for Scope 1+2 and Scope 3 emissions reductions aiming for 2030. In FY2022, we established the Carbon Neutral Promotion Department within the Corporate Planning Division (renamed the Carbon Neutral Planning and Management Department in FY2024, and reorganized as a department directly under the President in FY2025) to further promote decarbonization. In March 2023, we established a roadmap for achieving carbon neutrality by 2050 as part of our medium-term management plan to realize our long-term vision 〈TOA 2030〉. In March 2024, based on this roadmap, we formulated a transition plan that quantifies the reduction effects of Scope 1 and 2 emissions through various initiatives. Furthermore, we are promoting greenhouse gas reduction across the entire value chain with the aim of achieving Scope 3 emissions reduction targets. The contents of the roadmap and transition plan are reviewed annually.

The TOA CORPORATION Group's Carbon Neutral Roadmap and Transition Plan

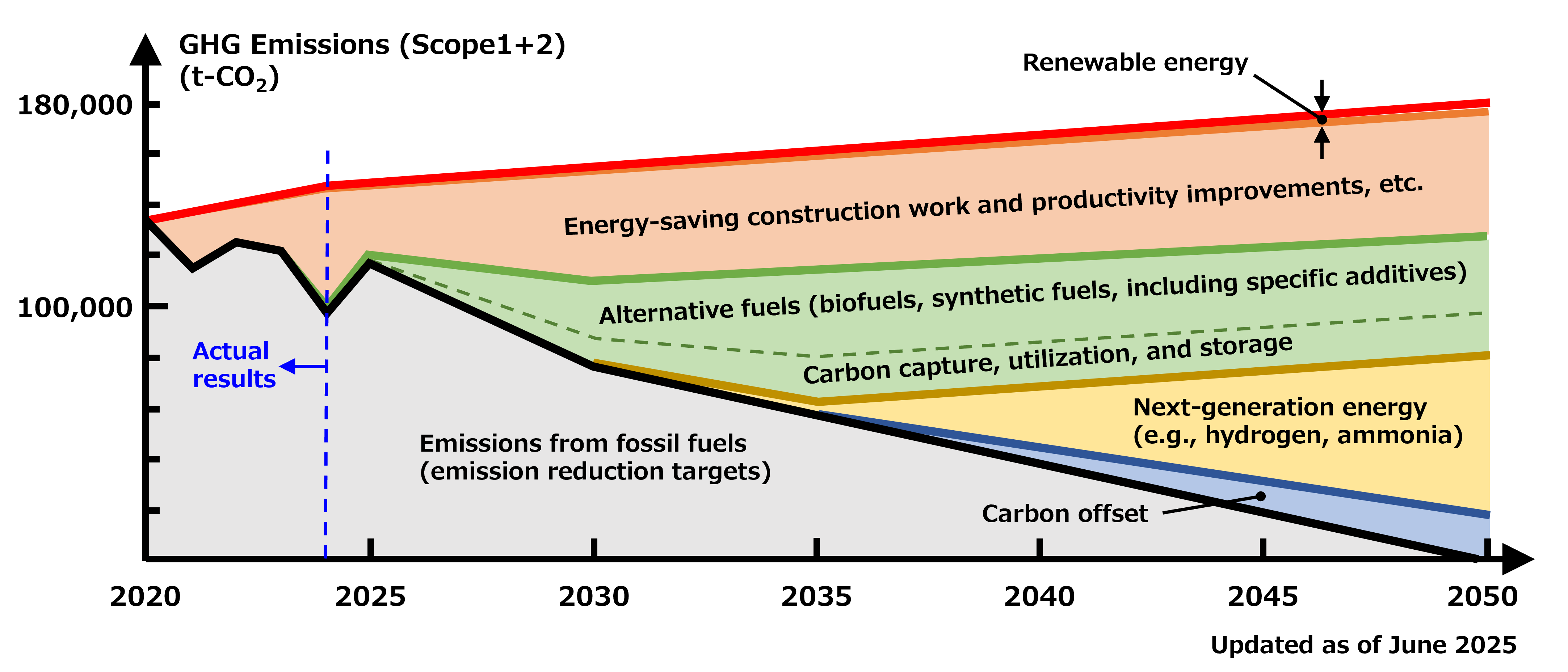

To further decarbonize our construction business, based on our carbon neutral roadmap, we have established a transition plan to align our group's GHG emissions reduction with the 1.5°C target (limiting global temperature rise to 1.5°C above pre-industrial levels). In addition to reducing emissions from our business activities, we are focusing on adopting low-carbon energy solutions and negative emission technologies. Furthermore, in addition to taking the lead in our own initiatives, we will steadily promote the realization of a decarbonized society in cooperation with various members of our supply chain.

Carbon Neutral Road Map

Transition Plan

Disclosure of Climate Change-Related Information in Line with the TCFD Recommendations

TOA CORPORATION Group expressed its support for the final recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) in December 2021.*1

TCFD is an international initiative established in 2015 by the G20 Financial Stability Board (FSB) to improve the disclosure of information on the financial impact of climate-related risks and opportunities. We disclose climate-related information in accordance with these TCFD recommendations.

*1 The TCFD was dissolved in October 2023. From 2024, IFRS (International Financial Reporting Standards) takes over the monitoring the progress of companies’ climate-related disclosures. We will continue to disclose information in accordance with the TCFD and IFRS S2 (climate-related disclosures).

Core Elements of Recommended Climate-Related Disclosure

| Governance | The organization’s governance around climate-related risks and opportunities |

|---|---|

| Risk management | The processes used by the organization to identify, assess, and manage climate-related risks |

| Strategy | The actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning |

| Metrics and targets | The metrics and targets used to assess and manage relevant climate-related risks and opportunities |

Governance

The ESG Committee has been established to promote company-wide ESG activities of the TOA CORPORATION Group. The committee is chaired by the President and consists of two Vice President, six General Managers, a Director who is a full-time Audit Committee member, and an Outside Director who is an Audit Committee member.

The ESG Committee meets twice a year to formulate basic policies and specific action plans concerning ESG activities, including responses to climate change, review the results of activities, and discuss measures. The results of the committee's deliberations are reported to the Board of Directors, and important decisions are communicated to business divisions (including branches) and group companies to establish a group-wide governance system. In the future, We aim to share ESG related policies and the plans with our partner companies.

Corporate Governance Organization Structure

Risk management

TOA CORPORATION Group has established a three-tier risk management framework, as illustrated in the Risk Management System chart, encompassing measures to address climate change.

At the first line, the relevant departments at head office and branch offices, along with group companies, formulate countermeasures for the risk items under their responsibility at the start of each period based on the annually reviewed risk inventory, thereby executing risk management. At the second line, the Risk Management Subcommittee, which comprehensively monitors group-wide risks, reports to the ESG Committee and proposes improvement measures based on the Group's risk response status and external environmental information. It also supports the first line's risk management activities. The ESG Committee deliberates on the Group's risk management policies and framework. It also reviews the risk inventory, issues countermeasure directives, and reports the situation to the Board of Directors. Furthermore, at the third line, the Internal Audit Office operates independently from the first and second lines. It collaborates to ensure appropriate risk management is carried out and reports the status of these efforts to the Board of Directors.

In classifying climate-related risks and opportunities, we organize the anticipated events and impacts for each, evaluating them based on ‘frequency of occurrence’ and ‘impact of occurrence’. We also consider preventive countermeasures for each risk and opportunity item.

Strategy

Based on the TCFD recommendations, we conducted scenario analyses to identify and evaluate risks and opportunities in our group and to understand the impact of climate-related issues on our business, taking all perspectives into account: short term (3 years), medium term (10 years), and long term (30 years). Furthermore, we evaluated the impact level in three stages (large, medium, and small) based on the frequency of occurrence and duration of impact and presented the high and medium impact levels in the table below (Major Business Risks and Opportunities).

In conducting the scenario analysis, the following representative scenarios are adopted.

| Temperature rise scenario | Adopted scenario |

|---|---|

| 1.5℃ | IEA NZE2050 Among the scenarios developed by the International Energy Agency (IEA), we used the "NZE2050" scenario. This is a scenario in which net zero emissions will be achieved by 2050 to limit the temperature increase at the end of this century to less than 1.5°C compared to pre-industrial period. The results of this analysis also include a review of the analysis of the Sustainable Development Scenarios "SDS" developed by the IEA. |

| 4℃ | IPCC SSP5-8.5 We used the "SSP5-8.5" scenario, developed by the Intergovernmental Panel on Climate Change (IPCC), in which the temperature-rise at the end of this century will exceed 4°C compared with the pre-industrial period. |

Climate-related Risks, Opportunities and Countermeasures (Results of Scenario Analysis)

(Risks and opportunities assessed as having a ‘high’ or ‘medium’ impact in either the 1.5°C or 4°C scenario are listed.)

| Risks / Opportunities | Impacts | Impact level | Countermeasures | ||||

|---|---|---|---|---|---|---|---|

| Transition risk | Introduction of carbon tax and strengthening regulations for decarbonization |

|

Large (1.5℃) |

|

|||

| Changes in the energy mix |

|

Medium (1.5℃) |

|

||||

| Physical risk | Increase in the average temperature |

|

Large (4℃) |

|

|||

| Aggravation of natural disasters |

|

Medium (4℃) |

|

||||

| Opportunities | Products/Services | Growing demand for environmentally friendly buildings |

|

Large (1.5℃) |

|

||

| Market | Increased demand for carbon-neutral facilities |

|

Large (1.5℃) |

|

|||

| Market | Increased demand for renewable energy |

|

Large (1.5℃) |

|

|||

| Products/Services | Growing demand for creation of Blue Carbon |

|

Medium (1.5℃) |

|

|||

| Resilience | Improvement of evaluation against the efforts for climate change |

|

Medium (1.5℃) |

|

|||

| Market | Market changes associated with climate change |

|

Large (4℃) |

|

|||

| Products/Services | Increased construction demands due to sea level rise |

|

Large (4℃) |

|

|||

Based on these results, we are strategically addressing the following issues as specific responses and are maximizing business opportunities while limiting negative financial impact.

- Reducing CO2 emissions at the construction stage (energy-saving construction, productivity improvement, introduction of low-carbon construction equipment and fuels, procurement of electricity from renewable energy sources, R&D on low-carbon concrete, and R&D on CO₂ capture and utilization technologies, etc.)

- Promoting ZEB/ZEH in buildings (registration as a ZEB Planner/ZEB Leading Owner)

- Participating in Initiatives in offshore wind power generation projects (shipbuilding of self-elevating platform, and R&D for construction of floating type facilities)

- Conducting R&D of technologies that contribute to disaster prevention/mitigation and renewal of infrastructure

- Conducting R&D of technologies for the creation of blue carbon

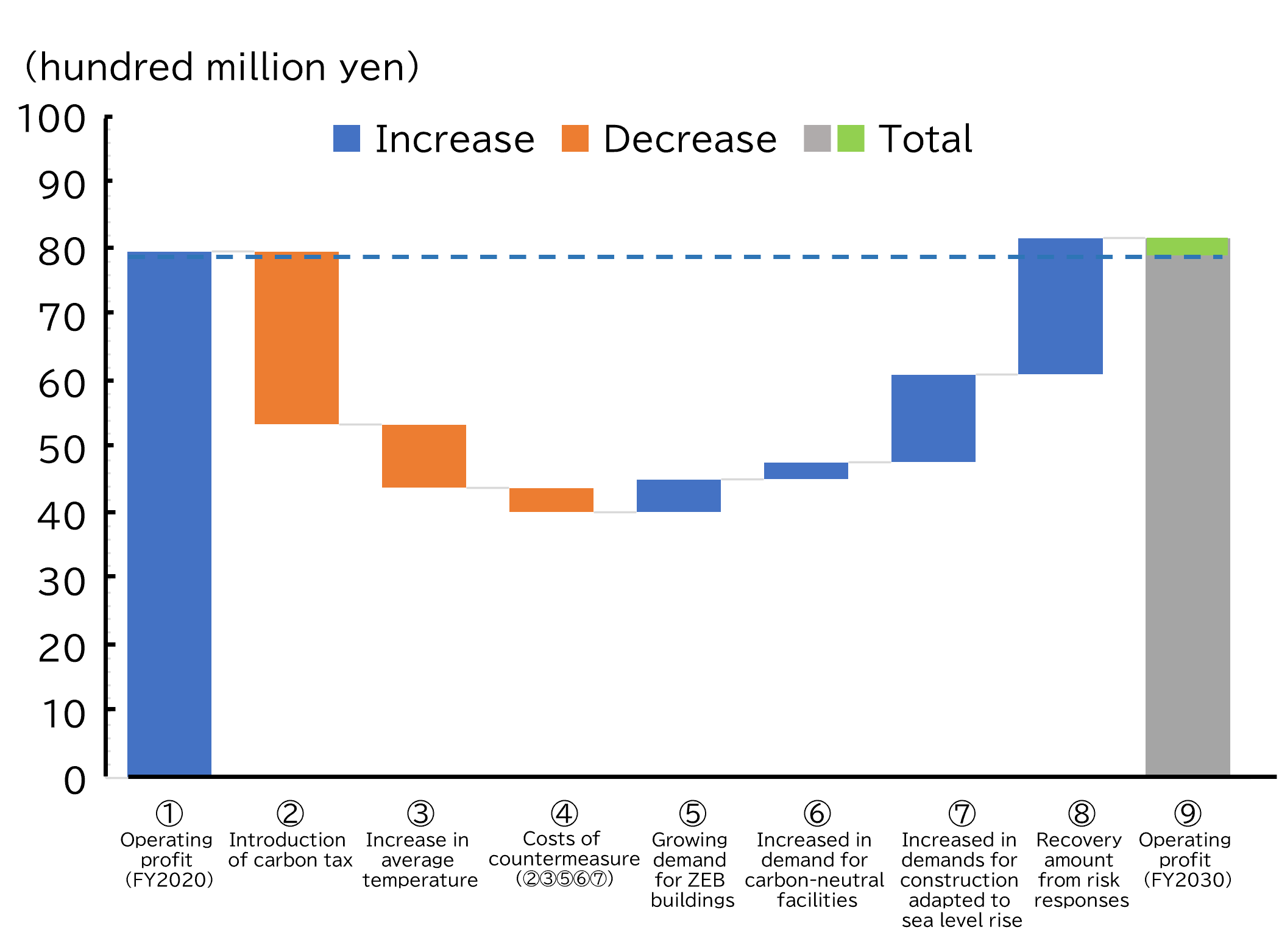

Financial Impact Assessment for 2030

We believe that climate change will have a significant financial impact on our business environment in 2030 under the 1.5°C scenario and have therefore conducted a financial impact assessment under this condition.

Financial impact assessment results (2030, 1.5°C scenario)

Under the 1.5°C scenario, the costs associated with introduction of carbon tax and responding to increase in the temperatures would be extremely high. However, implementing measures such as emission reduction based on transition plans and countermeasures for heatstroke would significantly reduce the risks. Additionally, by actively expanding opportunities in response to increased demand for ZEB/ZEH buildings and disaster prevention measures in port and coastal areas, profits increased compared to FY2020.

As a result, it was confirmed that by consistently implementing countermeasures to address risks and opportunities, a certain level of resilience to climate change will be achieved by 2030.*2

Going forward, we will also actively conduct future projections under the 4°C scenario.

*2 Uncertainty in future forecasts in financial impact assessments

Based on the TCFD recommendations, we conducted qualitative and quantitative analyses of financial impact assessments. These impact assessments are forecasts of the highly uncertain future, and we plan to review them as necessary in the event of changes in internal figures or parameters.

Main parameters used in scenario analysis

| Carbon price (yen/t-CO2) | IEA Net Zero by 2050 A Roadmap for the Global Energy Sector |

|---|---|

| Estimated average unit price for labor | Unit price for labor in public works designed in 2024 |

| Number of days with temperatures above 30°C | Global Warming Prediction Information, Volume 8, 3.9 (Japan Meteorological Agency) |

| Cost increase rate of ZEB buildings compared to general buildings | ZEB Design Guidelines (Sustainable open Innovation Initiative) |

| Elevation height of revetment facilities to cope with sea level rise | Policy for Implementing Climate Change Adaptation Measures in Ports and Harbors, 14 March 2024 (Ports and Harbors Bureau, Ministry of Land, Infrastructure, Transport) |

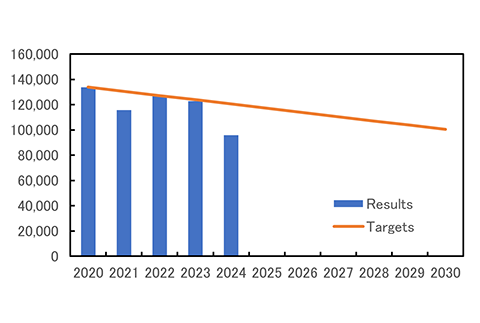

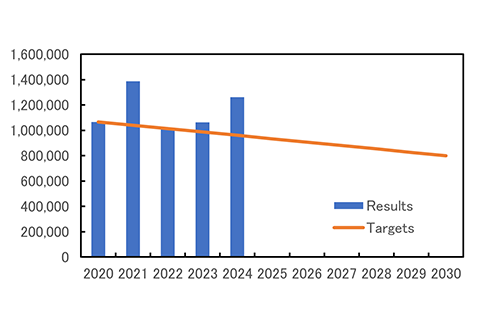

Metrics and Targets

We have established key performance indicators (KPIs) for ESG-related initiatives and monitor their status. As one of KPIs, we have set the total greenhouse gas emissions (Scope 1+2 and Scope 3) as metrics, and established its reduction target based on SBT, in consideration of the impact of future climate-related risks and opportunities. These had certified as WB2°C target by the SBT initiative in September 2022. In addition, for Scope 1+2, Net Zero target by FY2050 was set in March 2023. We manage the total greenhouse gas emissions as a direct parameter affected by climate-related risks and opportunities and promote specific reduction measures.

| Total emissions Scope1 + 2 |

More than 25% cut in FY2030 (Compared to FY2020) *3 Net Zero by FY2050 |

|---|---|

| Total emissions Scope3 |

More than 25% cut in FY2030 (Compared to FY2020)*3 |

*3 The above targets were approved by SBT initiative as Science Based Targets (WB2°C targets) in September 2022.

(Reference) Explanation of Terms

- SBT(Science Based Targets)

Greenhouse gas emission reduction targets set by companies, consistent with the levels required by the Paris Agreement. - Paris Agreement

An international agreement on greenhouse gas reductions agreed by Conference of the Parties (COP) to the United Nations Framework Convention on Climate Change (UNFCCC) in Paris in 2015. The common long-term global goals are: (1) to keep the global average temperature increase well below 2°C above pre-industrial levels and to limit it to 1.5°C; and (2) to peak out global greenhouse gas emissions as soon as possible to achieve a balance between emissions and absorption (by forests, etc.) in the second half of the 21st century. - SBTi (Science Based Targets initiative)

An international initiative encouraging companies to set greenhouse gas emission reduction targets consistent with scientific findings to achieve the goals of the Paris Agreement. It is jointly operated by four organizations: CDP (International NGO on Environmental Information Disclosure), UNGC (United Nations Global Compact), WRI (World Resources Institute), and WWF (World Wide Fund for Nature). - WB 2°C target (Well-below 2°C)

A target level of greenhouse gas emission reduction consistent with limiting the increase in global average temperature to well below 2°C above pre-industrial levels.

Results of Greenhouse Gas (GHG) Emissions

GHG Emissions of the TOA CORPORATION Group (by Scope)

Total GHG emissions of the TOA CORPORATION Group (by Scope) are shown below.

Scope1 + 2 Emissions (t-CO2)

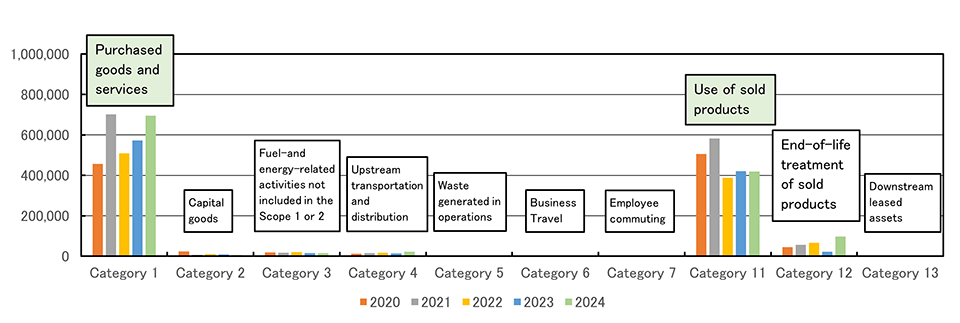

Scope3 Emissions (t-CO2)

Scope3 Emissions by Category (t-CO2)

As for actual GHG emissions in FY2024, for Scope 1+2, energy conservation activities, introduction of load control systems (introduced on some of our work vessels), use of electric and hybrid heavy equipment (introduced mainly in construction equipment for land-based work), fuel efficiency improvement (use of alternative fuel to diesel oil and combustion-enhancing additives), and introduction of renewable energy were carried out, and these measures resulted in a 28.4% reduction compared to the base year (FY2020) emissions, significantly exceeding the target of a 10% reduction.

Scope 3, although we promoted environmentally conscious designs such as ZEB (Zero Energy Building) for buildings, the significant increase in construction materials due to a substantial increase in business volume had a major impact, resulting in an 18.2% increase from the base year (FY2020) emissions (the target was 10% reduction from the base year). Going forward, we will further engage and collaborate with our supply chain, focusing even more on initiatives such as ZEB for buildings and the introduction of low-carbon materials.

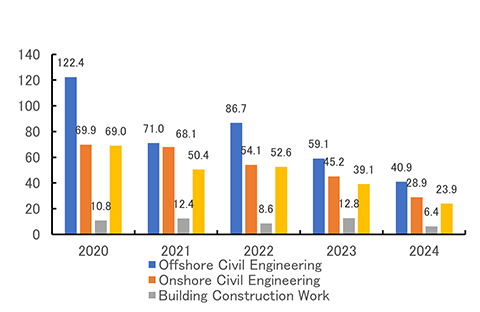

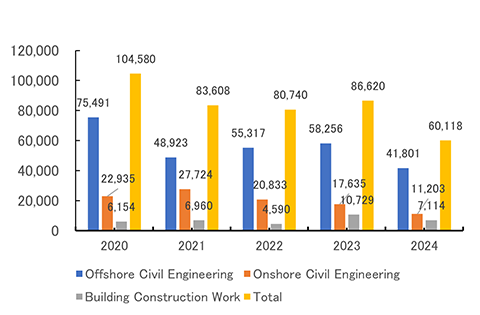

CO2Emissions from Domestic Construction Works

CO2 emissions from our domestic construction works are calculated based on sampling surveys, and CO2 emission intensity (per 100 million yen of construction sales) and total CO2 emissions are shown in the figures below. This total amount of CO2 emissions is equivalent to Scope 1+2 for domestic construction works.

CO2Emission Intensity (t-CO2 per 100 million yen)

Total CO2 Emissions (t-CO2)

In FY2024, both civil engineering and building construction work experienced a significant increase in construction volume compared to the base year (FY2020). However, emissions intensity for both civil engineering and building construction work decreased significantly, resulting in a decrease in total emissions. Overall, the total emissions from domestic construction projects in FY2024 decreased by 42.5% compared to FY2020. This result has also contributed to the reduction of Scope 1+2 emissions (achievement of targets) for our group.

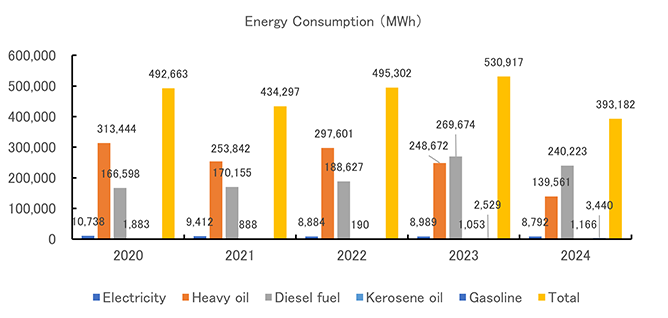

Energy Consumption

As input resources corresponding to the above GHG emissions, the total energy consumption of our group is shown below.

Energy Consumption (MWh)

Third-party assurance

The above greenhouse gas emissions and energy consumption have been given assurance by an independent third-party.

Independent Third-Party Assurance (PDF)

Climate Change Related Initiatives

Through supporting various climate change-related initiatives below, the TOA CORPORATION Group will promote ESG management from a more global perspective and create social value that is unique to TOA.

CDP

CDP is the global environmental non-profit organization that operates the world’s only independent environmental disclosure system. In 2025, 640 investors with $127 trillion in assets asked CDP to collect data on environmental impacts, risks and opportunities, and more than 22,100 companies reported through CDP’s platform.

We have been selected for the second consecutive year as an “A List” company, the highest rating in the field of climate change of CDP 2024 and 2025. We have been recognized as our ongoing initiatives and disclosures on climate change. Furthermore, we have been selected as a "Supplier Engagement Leader," the highest rating for two consecutive years in 2023 and 2024 CDP’s annual Supplier Engagement Assessment (SEA). The SEA evaluates supplier engagement efforts in the categories of “targets”, “supplier engagement”, “scope 3 emissions”, “risk management processes” and “governance and business strategy”.

Science Based Targets initiative (SBTi)

An international initiative encouraging companies to set greenhouse gas emission reduction targets consistent with scientific findings to achieve the goals of the Paris Agreement. It is jointly operated by four organizations: CDP (International NGO on Environmental Information Disclosure), UNGC (United Nations Global Compact), WRI (World Resources Institute), and WWF (World Wide Fund for Nature).

Task Force on Climate-related Financial Disclosures (TCFD)

TCFD is the international initiative established in 2015 by the G20 Financial Stability Board (FSB) to improve the disclosure of information on the financial impact of climate-related risks and opportunities. The TCFD was dissolved in October 2023.

Japan Climate Initiative (JCI)

Japan Climate Initiative is a network of various non-state actors such as companies, local governments, organizations and NGOs actively engaged in climate action.