Corporate Governance

1. Basic view

Under the management philosophy of “striving for prosperity through advanced technology and fulfilling social responsibilities through sound management,” the Group has set the long-term vision , which is “Building a prosperous society and connecting people with the world for a better future.” By steadily implementing its domestic civil engineering business, domestic building construction business, overseas business, and other businesses, the Company aims to achieve management practices that are trusted by all stakeholders and meet their expectations. At the same time, the Company will promote ESG management to contribute to a sustainable society and the achievement of the SDGs. Our basic policy is to continually ensure the soundness and transparency of our corporate activities by consistently adhering to laws, regulations, social norms, and corporate ethics, and by establishing a management structure that enables prompt and flexible responses.

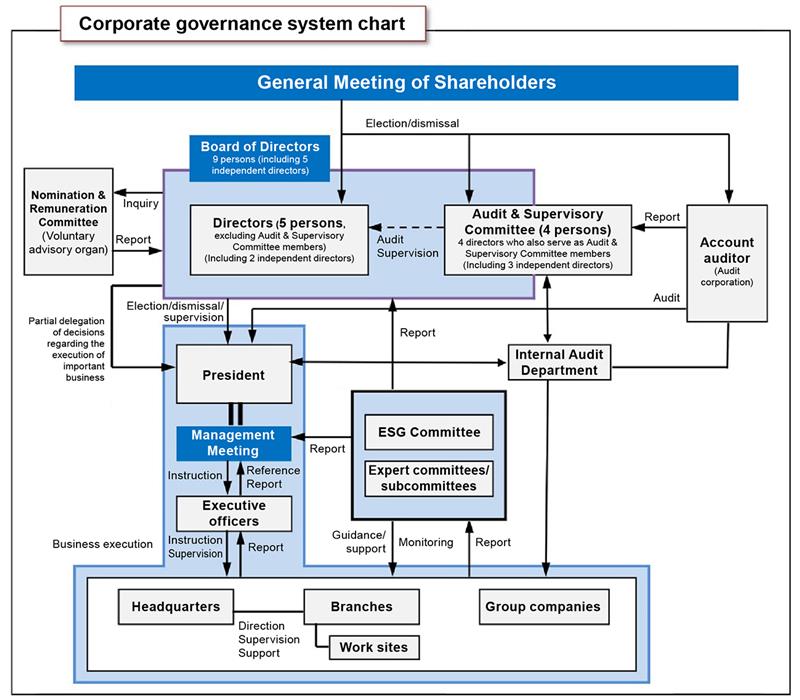

2. Matters concerning functions of business execution, auditing and supervision, nomination, and remuneration decisions (overview of current corporate governance system)

-

1. Directors deliberate, decide, and report on important matters stipulated in laws and regulations, the Articles of Incorporation, and the Standards for Board of Directors Meeting Agenda at Board of Directors meetings held at least once a month, and

make management decisions regarding important matters for the Company and the Company group.

The Board of Directors delegates the authority to the President for a part of important business execution, and for the purpose of swift and appropriate execution of business, important matters related to business execution are deliberated and reported at the Management Council meetings, which are held once a week, and are decided.

Furthermore, the Company has adopted an executive officer system that separates management and execution, where Directors are responsible for management decision-making and Executive Officers are responsible for business execution. - 2. Regarding the procedures for determining nomination and remuneration of Directors and Executive Officers, in order to ensure fairness, transparency, and objectivity in the determination, the Nomination & Remuneration Committee, which is a voluntary committee, with Independent Outside Directors forming a majority and chaired by an Independent Outside Director, deliberates on nomination and remuneration, and the Board of Directors makes decisions based on the Committee’s report.

- 3. The Audit & Supervisory Committee, as its basic configuration, has four members, consisting of three highly independent Outside Directors and one full-time Director from within the Company. In cooperation with the internal audit division, the Committee is working to strengthen its effective auditing and information gathering systems. In addition, the Committee monitors the execution of duties by Directors by such means as attending important meetings, hearing reports from Directors and other relevant personnel, conducting field audit of each business site including the head office, hearing about the status of subsidiaries, and inspecting important documents. The Audit & Supervisory Committee has members who are certified public accountants (one of them is also a licensed tax accountant), and have considerable knowledge of finance and accounting. In addition, as the full-time Audit & Supervisory Committee Member, a person has been appointed who had been in the administration division of the Company for many years and can monitor and audit the execution of duties by Directors based on the knowledge and experience cultivated in the course of his career in the administration division.

- 4. Regarding internal audits, the Company has established the Internal Audit Department, which conducts audits in accordance with the Internal Audit Regulations to strengthen the effectiveness of the internal control system.

- 5. The Company has appointed five Outside Directors, all of whom have no personal, capital, or business relationships with or other interest in the Company. In other words, none of the Outside Directors fall under any of the following categories: (1) a major shareholder of the Company or an executive thereof, (2) a person/entity for which the Company is a major client or an executive thereof, or (3) a consultant, accounting expert, or legal expert who receives remuneration from the Company in addition to remuneration as a director/company auditor, nor are they close relatives of persons listed in (1) through (3).

- 6. The Company appoints as Outside Directors persons who have a wealth of knowledge and experience in various fields, and 14 expects their role to be to ensure sound management by supervising and auditing from a neutral and objective perspective. In order to ensure the independence of Outside Directors invited by the Company, the Company has established the Independence Verification Items, for which purpose it referred to Rule 436-2 “Securing Independent Director(s)/Auditor(s)” of the Securities Listing Regulations, and the Guidelines concerning Listing Examination as stipulated by Tokyo Stock Exchange, Inc. and other rules. In order to satisfy the purpose of appointing Outside Directors, the Company pays attention to ensuring their independence and will not appoint as Outside Directors those whose independence it is in practice difficult to ensure.

- 7. Pursuant to Article 427, Paragraph (1) of the Companies Act, the Company has concluded contracts with Directors who do not execute business to limit their liability under Article 423, Paragraph (1) of the said Act. The maximum amount of liability for damages under such contracts is the minimum liability amount stipulated in Article 425, Paragraph (1) of the said Act. Such limitation of liability is only permitted if such Director has incurred any liability in the course of executing his/her duties in good faith and without gross negligence.

-

8. The Company has appointed Ernst & Young ShinNihon LLC as the Accounting Auditor.

The composition of the certified public accountants who performed the accounting audit in FY2024 and the assistants for the audit are as follows:

Names of the certified public accountants who performed the accounting audit

Hidenori HaraYoji Yuki

Composition of assistants for the accounting audit

Certified public accountants: 7 persons Others: 14 persons